Old Tax Regime 2025-24 - Old Tax Regime 2025-24. Explore potential amendments to presumptive taxation, concerns about the new tax regime impact, and insights on faceless assessment in the recent interim budget. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. No changes are announced in the old tax regime in interim budget.

Old Tax Regime 2025-24. Explore potential amendments to presumptive taxation, concerns about the new tax regime impact, and insights on faceless assessment in the recent interim budget. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

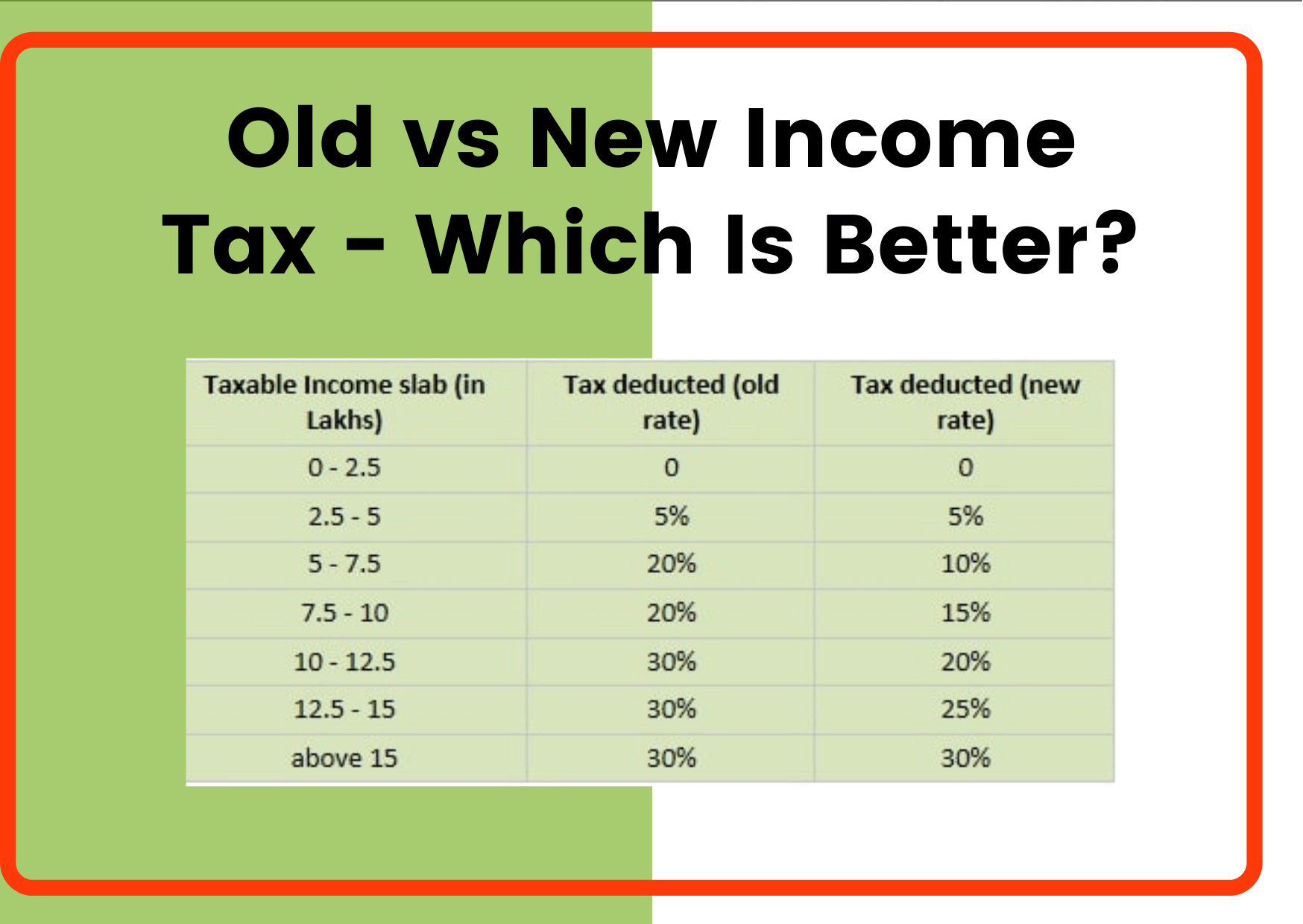

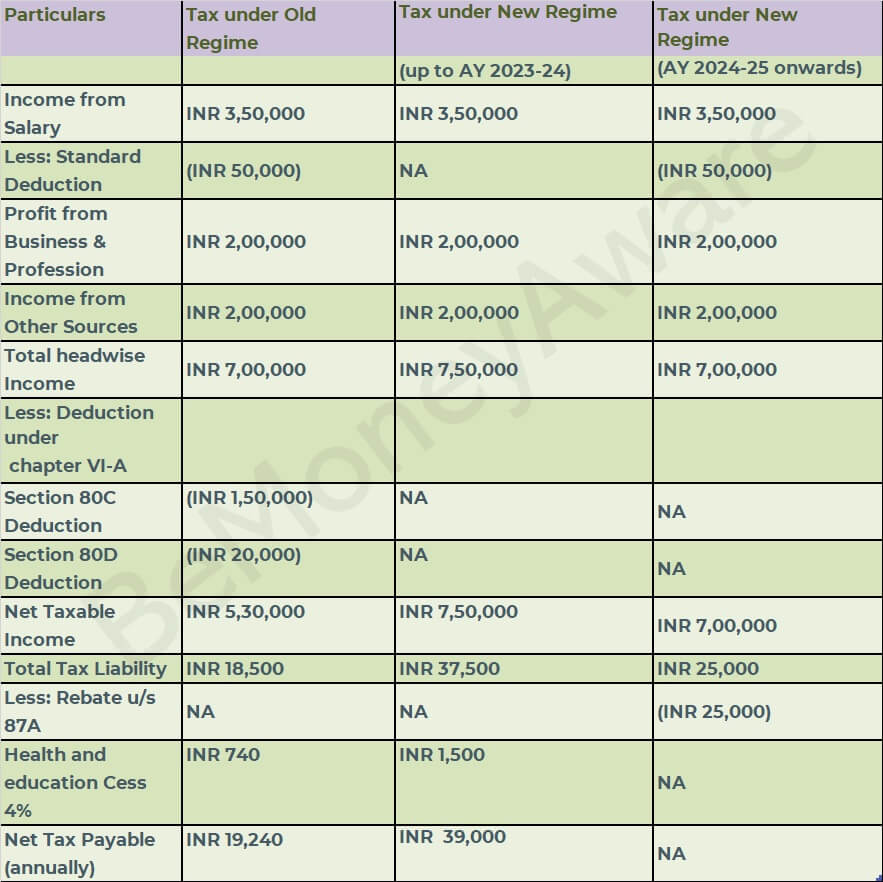

Old vs New Tax Regime Slab Rates FY 202324 FinCalC Blog, 1) income tax exemption limit increased from rs 2.5 lakh to rs 3 lakh. You can make use of this calculator for calculating tax liabilities as per old as well as new tax slabs.

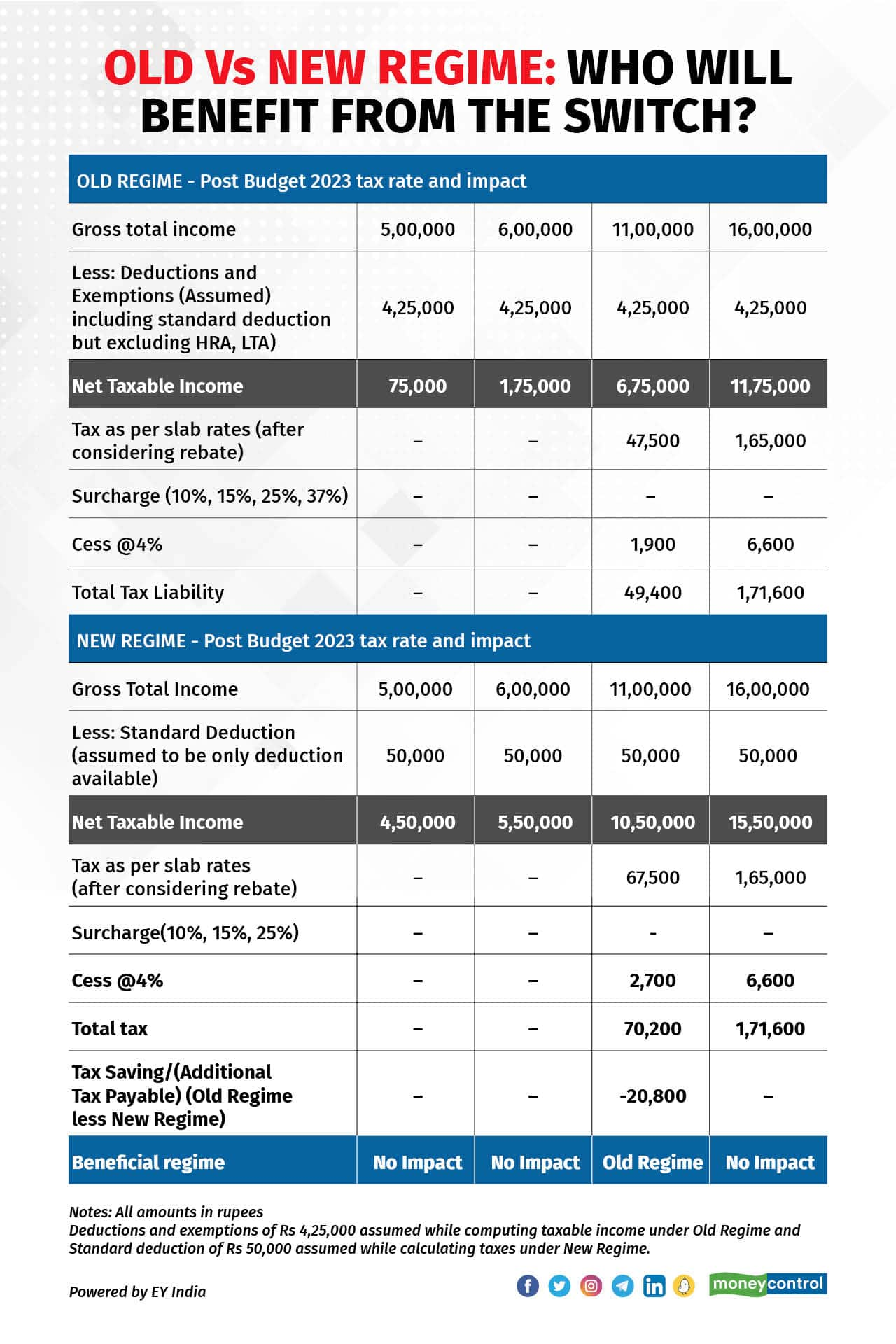

Old or New Tax Regime?, Can i use the old tax regime for 2025? 3) going forward, the new income.

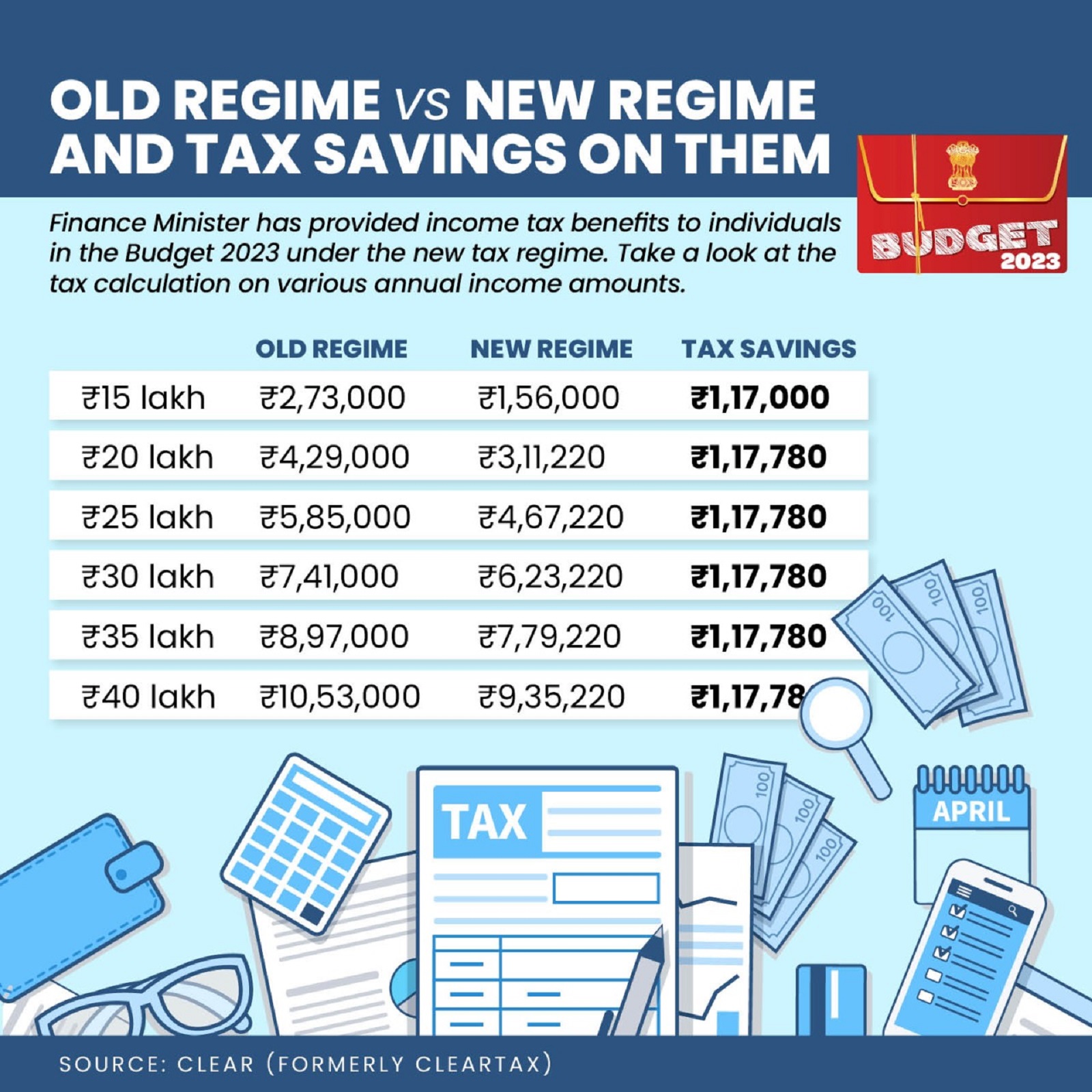

Under the old tax regime, the tax deduction is 30% while for the new tax regime it is 15%.

Difference Between Old Vs New Tax Regime Which Is Better Vrogue, The federal income tax has seven tax rates in 2025: Explore potential amendments to presumptive taxation, concerns about the new tax regime impact, and insights on faceless assessment in the recent interim budget.

31 jan, 2025 | 04:36:19 pm ist finance minister nirmala sitharaman is.

New Vs Old Tax Slabs Fy 2025 23 Which Is Better Calculator Stable www, The top marginal income tax rate of. You can compare your tax and decide which tax slab to opt.

Tax Slabs Fy 2023 24 Image to u, Income tax slabs (in rs) income tax rate (%) between 0 and 3,00,000: Understand ctc, exemptions, and make informed decisions.

Why the new tax regime has few takers, Income tax calculator to know the taxes to be paid for a given income and to compare old vs new tax regimes (scheme) for it declaration with your employer or to know your tax. However, based on your investments and other tax saving procedures take a call to see.

1) income tax exemption limit increased from rs 2.5 lakh to rs 3 lakh. However, based on your investments and other tax saving procedures take a call to see.

Should I Switch To New Tax Regime? Tax Calculator And More, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. However, this benefit of choice is subject to.